If you own a business, understanding accounting terms is not likely at the top of your list. It’s understandable; you may be juggling several responsibilities at once or simply do not have the time. Besides, if you pay an accountant or bookkeeper to manage your books, why do you need to know this stuff?

A basic understanding of accounting terms can equip you to make better financial decisions. It will also give you a greater sense of control over your business operations. Let’s cover some basic accounting terms every business owner should know.

What you own and who you owe

In order to understand the health of your business, you want to start with what the company owns and who they owe. These items are usually found on a company’s balance sheet in the form of assets, liabilities, and equity.

Assets – Assets are things you own. The most common assets in a business are cash and money in the bank. Assets can also include money owed to you (also known as receivables), inventory, equipment, and other property.

Liabilities – Liabilities are things you owe. Typically these include money owed to others (payables), credit card debt, taxes due, and loans. Liabilities can be short-term (less than one year) or long-term (over twelve months).

Equity – Equity is what you as the owner of the company have invested in the business. This can include stock, owner’s investment, and the value left in the business after the assets are used to pay off any outstanding liabilities.

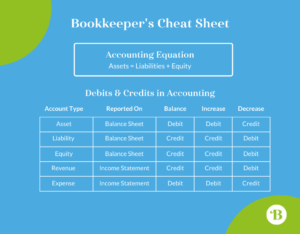

A common formula used by accountants is Assets = Liabilities + Equity. Modern accounting is built on this formula.

What you earn and what you spend

Most business owners focus on their company’s income statement to understand the health of their business. This report gives you a snapshot of business activity at a given point in time. What terms should you understand in this report?

Revenue – Revenue is the income that a business generates from its normal business activities. Typically these include income generated from the sales of products and/or services. A business can have one or several revenue accounts, depending on the types of products/services they provide.

Expenses – Expenses are the costs incurred in operating the business. Expenses can take the form of a one-time purchase or repeating monthly costs. They can include such things as wages, rent, dues, supplies, and the like.

When you subtract the cost of expenses from your Revenue, the result is called the Net Profit (or Net Loss). To be considered profitable, the goal is to generate more income than what you are spending for the same period.

The terms we have covered so far frequently appear on a company’s financial reports. To help you keep it all straight, we’ve provided a handy graphic below:

It’s all about debits and credits

Some people are familiar with the concept of debits and credits. A bank may “credit” your bank account for the portion of a deposit that was missing. Or you may use a “debit” card to pay for expenses. Do these terms mean the same thing in accounting?

Let’s provide some context first. Most bookkeeping today follows a method called “double-entry accounting”. Basically, each time a transaction occurs, it is recorded in two separate areas of your books. This process is accomplished by posting debits and credits.

Depending on the type of account involved, debits or credits will either increase or decrease the overall amount over a period of time. Rather than give a lengthy explanation of when to use a debit or credit, we provided a Bookkeeper’s Cheat Sheet to help you out.

Here are the most important rules to remember when it comes to debits and credits:

Rule 1: Total of all debits must always equal total of all credits

Rule 2: Debits are always on the left

Rule 3: Credits are always on the right

With just these few accounting terms under your belt, you can do much to understand and plan the future of your business. Looking for more assurance that your books are right? Check out this article on how to determine if your accounting records are accurate.