January is here and with it comes the task of determining who requires a 1099-MISC form. Running a 1099 report in Xero is very useful in the review process. It is designed to help you locate contacts and payments that qualify for 1099 reporting.

Note: To run the 1099 Report, you must have Advisor access to the company file.

How does it work?

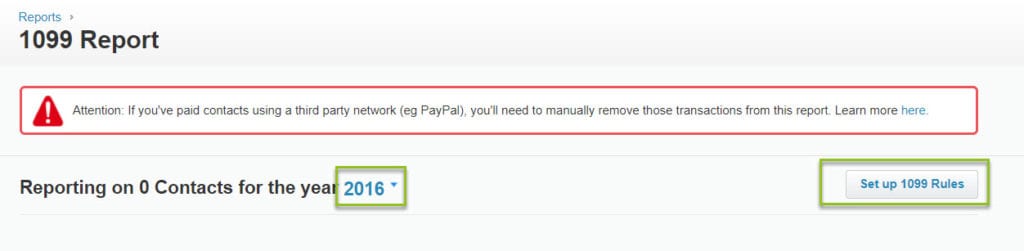

Go to Accounting>Reports. Under Tax, click 1099 Report.

First, choose the year that you want the report to review. Next, you will need to set up 1099 rules. Select the Set up 1099 Rules button.

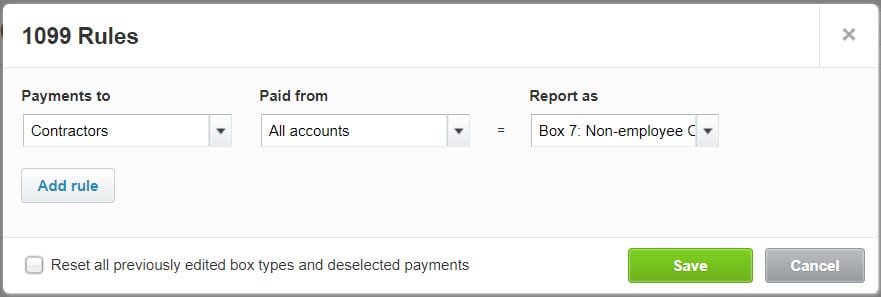

The rules consist of 3 fields: Payments to, Paid from, and Report as:

- Payments To: These are the contacts that you will be reporting. If you choose “All contacts”, then Xero will review all payments. If you choose a contact group, Xero will review only payments made to contacts in this group.

- Paid From: You can choose to have Xero review “All accounts” if you chose a contact group in the “Payments to” field. If you chose “All contacts”, then you can choose individual expense accounts.

- Report As: This field is where you map the payments to boxes on the 1099-MISC form.

Once you have set up the rules, click Save. Then Xero will run the report and results will appear. Xero will also let you know if you are missing any details that are necessary for 1099 reporting.

When you click on the results, you can view and edit the contact and payment details. To exclude an individual payment that is not reportable, simply unselect the box under “Include”.

It should be noted that this report is designed as a review tool only. Often additional review is necessary to guarantee that the 1099s are filed according to the IRS instructions. Please contact us if you are interested in our 1099 filing service.