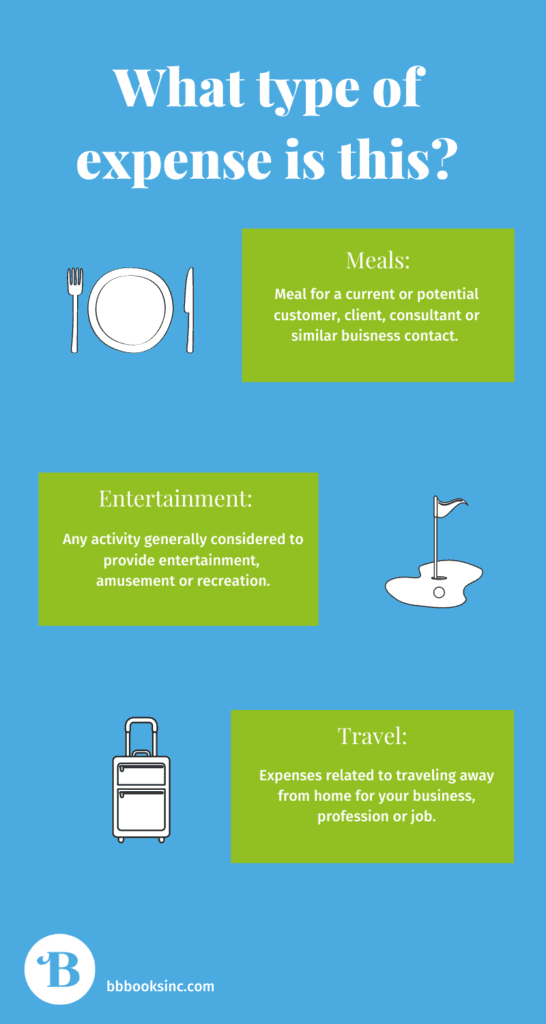

One of the most misunderstood business expenses are those related to travel, meals, and entertainment. It can be hard to know how to classify these types of expenses because often the line can be a little blurry on what type of expense it actually is.

Understanding these types of expenses is even more important now, due to recent changes on the deductibility of some of these types of expenses. At the bottom of this article, be sure to refer to our handy cheat sheet for understanding travel, meals and entertainment expenses.

Keep good receipts

Keeping good receipts is vital! Anyone in the company with access to credit cards or purchase accounts should be responsible for providing receipts. This prevents misuse and fraud. One great app to track receipts is Dext, which is especially good for handling multiple corporate cards. Another app we like is Expensify, which is especially good for managing employee reimbursements, especially travel-related expenses.

Have a policy for travel expenses

It’s important to have a clear written policy for anyone who travels for the company. A good travel expense policy will:

- Clearly state per diem or other limits on what can be charged to the company

- Outline when and how receipts should be provided

- Outline mileage and other reimbursement rates

Know the Tax Rules for Entertainment

There have been many changes recently regarding how meals and entertainment expenses should be treated.

Generally, you can’t deduct any expense for an entertainment event. Here is the definition of entertainment expenses per the IRS:

Entertainment includes any activity generally considered to provide entertainment, amusement, or recreation. Examples include entertaining guests at nightclubs; at social, athletic, and sporting clubs; at theaters; at sporting events; on yachts; or on hunting, fishing, vacation, and similar trips.

Additionally, the deduction may depend on your type of business.

Your kind of business may determine if a particular activity is considered entertainment. For example, if you are a dress designer and have a fashion show to introduce your new designs to store buyers, the show generally isn’t considered entertainment. This is because fashion shows are typical in your business. But, if you are an appliance distributor and hold a fashion show for the spouses of your retailers, the show generally is considered entertainment.

There are some exceptions, such as:

Recreational expenses for employees such as a holiday party or a summer picnic; Expenses related to attending business meetings or conventions of certain exempt organizations such as business leagues, chambers of commerce, professional associations, etc.

Know the Tax Rules for Meals

There have been some changes recently to how some meals should be treated as well. Per the IRS:

Generally, you may continue to deduct 50% of the cost of business meals if you (or an employee) is present and the food or beverages are not considered lavish or extravagant. The meals may be provided to a current or potential business customer, client, consultant, or similar business contact. Food and beverages that are provided during entertainment events are not considered entertainment if purchased separately from the entertainment, or if the cost of the food and beverages is stated separately from the cost of the entertainment on one or more bills, invoices, or receipts

It’s important that you do your research and consult the experts. IRS Publication 463 discusses the treatment of travel, entertainment, and meal expenses in detail. It’s important to discuss with your tax scenarios that are common to your business.

Update (5/24/2021): For 2021 and 2022 years only, the IRS has recently issued Notice 2021-25 which allows for 100% deduction for business meal expenses. The 100% deduction is available when food and beverages are paid for and provided by a restaurant. We recommend following up with your tax professional to discuss the potential tax impact on your business.

Analyze your return on entertainment-related expenses

We are not saying that you should never show appreciation to your clients. However, if you are spending hundreds or thousands of dollars on golf outings or other recreational events for your clients with little referrals or increased business. you might want to consider a different strategy. It’s important to periodically examine the ROI – Return on Investment.

It can be beneficial to create a marketing plan at the beginning of the year. You can think about what type of promotions you could have to generate new business, and you can think about what current client promotions you plan to keep for repeat customers. By having a plan in place, you can make sure that you are not going too crazy with travel, meals, and entertainment expenses!

Expenses for meals, entertainment, and travel are just one area of your business to keep a watchful eye on. Another good idea for a small business owner is to save for taxes. Check out this article to learn the benefits of having a good tax savings plan and how to do it.

Updated 8/30/2021