You trust your employees and want to help them in times of need. In some cases, that may mean extending to them a payroll advance. However, trust is a two-way street. While you want to be helpful, you also want to trust that your employees will pay you back.

What is the best way to manage employee advances to prevent misunderstanding and hurt feelings? Here are some helpful tips for managing this situation.

Establish the arrangement in writing

Once you and your employee have established the amount to be advanced, decide how you would like the advance repaid. It can be one lump sum or split up into installments until the total has been repaid.

Once you have come up with the terms of your advance agreement, put it in writing! Have all terms written down and signed by both parties. Having terms in writing will help avoid misunderstandings between both parties.

Record the advance in your accounting software

The next step will be to record the advance into your accounting software. This will allow you to keep track of both the advance itself and how much your employee has paid you back.

One way to do this is to add the advance as an “Other Receivables” entry. Below is an example of the entry in QuickBooks Online (QBO).

The total amount will now show on your balance sheet.

Each time your employee makes a payment, you will enter that amount into the same general ledger account. If you find that employee advances are a more regular occurrence, you may consider creating a specific account category for employee receivables.

Set up reimbursements in your payroll system

Once you’ve recorded the advance to your employee, you need to set up a method to get paid back. The most common way to do this is through a post-tax payroll deduction on the employee’s paycheck.

Most payroll processors have the means to set up deductions for employee advances. For example, Gusto allows you to set up a post-tax deduction that can be used for reimbursements of employee advances. Let’s see how.

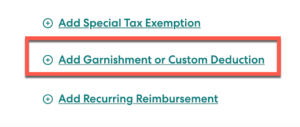

In Gusto, select People, then select the employee you wish to set up the deduction for. At the bottom of the employee’s profile, select Add Garnishment or Custom Deduction.

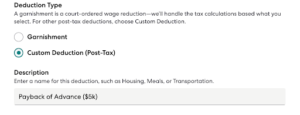

You will then add a few additional details. First, select Custom Deduction (Post-Tax). Next, give your deduction a name.

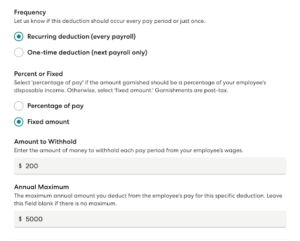

Gusto allows you to set up the frequency of your deduction as Recurring or One-time. You can also set the deduction as a percentage of pay or a fixed amount. For our example, we want to establish a recurring fixed amount deduction of $200 per pay period. You can also set the Annual Maximum field to match the total advance issued.

If everything looks good, select Save to set up the deduction on the next payroll. Gusto takes care of the rest!

Monitor that reimbursements are paid in full

Once you have a payroll deduction in place, you want to keep an eye on it to ensure that all the funds advanced to the employee are reimbursed in full. Why is there a need to monitor it so closely?

The beauty of a post-tax deduction is that you can set it and forget it. However, a common mistake that can occur is an employer continues to deduct from the employee’s paycheck after the advance is already paid.

Every payroll processor is different. That being said, in most cases, after you set the deduction, you usually need to manually turn it off after the advance has been fully reimbursed. In other instances, rolling over to a new year can reactivate some post-tax deductions in your payroll software.

Our recommendation is to refer to the Help Center of your payroll processor to understand how to set up and turn off post-tax deductions. Additionally, if you know approximately when the advance will be fully paid, you can set a reminder on your calendar to review payroll reports at a specific date to verify and discontinue the deduction.

Extending advances to employees can be difficult to navigate. Hopefully following the guidelines above will give you confidence about helping your employees while still maintaining a good working relationship. Are you concerned that your current payroll process could use an update? Check out this article about whether it’s time to outsource your payroll.