If you want a better understanding of your banking activity, the Bank Reconciliation Summary is a very useful tool to use. We use this report every day while we are working within Xero and we want to share with you how useful it can be too.

Where do you find the Bank Reconciliation Summary?

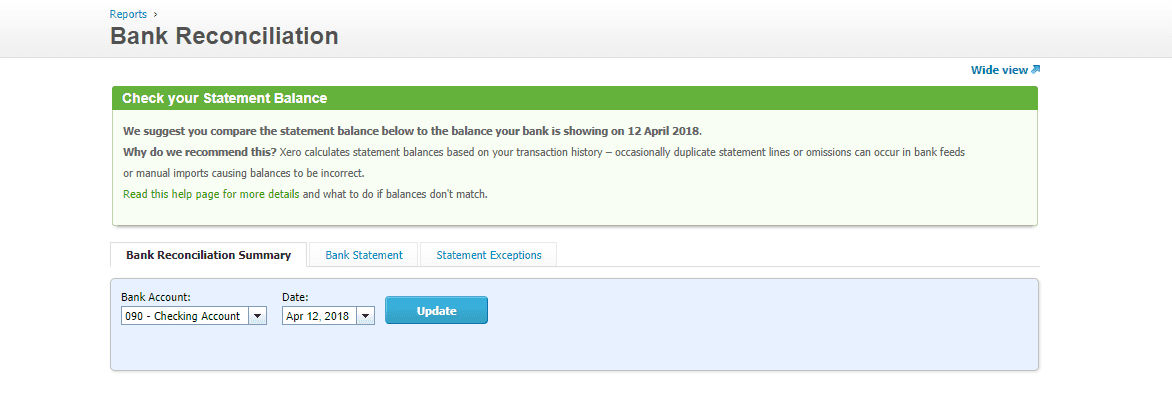

In Xero, go to Reports>All Reports>Accounting>Bank Reconciliation Summary.

From here you will enter the bank account that you are looking at and the date you are comparing. If you want to compare the report to a bank or credit card statement you should use the closing day of the bank or credit card statement.

What does the Bank Reconciliation Summary tell you?

The Bank Reconciliation Summary tells you the balance in Xero, the detail and total of all outstanding payments and receipts, the detail and total of all un-reconciled bank statement lines, and the statement balance.

- Balance in Xero – this is the balance of all transactions entered in Xero for the bank or credit card account through the date of the report.

- Less Outstanding Payments – these are the outstanding Spend Money (including checks) for transactions that have not been reconciled (matched) to a bank feed line.

- Less Outstanding Receipts – these are the outstanding Receive Money (deposit) transactions that have not been reconciled (matched) to a bank feed line.

- Plus Un-Reconciled Bank Statement Lines – these are the outstanding bank feed lines that need to either be reconciled (matched) to an existing transaction in Xero, or a new transaction needs to be created and then it needs to be reconciled (matched).

- Statement Balance – this is the balance per the bank feeds in Xero as of the report date.

What should you look for in the Bank Reconciliation Summary?

First, verify that the balance in Xero matches the ending balance on your bank or credit card statement.

Next, determine if it is reasonable that all of the outstanding payments and receipts have not cleared the bank. For outstanding payments, it is reasonable that a check written close to the ending date of the report is still outstanding. However, it might not be reasonable that a deposit that is dated a week or more from the ending date of the period is still outstanding.

You may determine that there are transactions that need to be removed or added. If all transactions have been reconciled (matched) and there are no outstanding transactions, the Balance in Xero and the Statement Balance will be the same amounts.

Checking the Bank Reconciliation Summary is something we do on a regular basis for our ongoing clients. Contact us if you would like to see how we can help you with one of our ongoing service packages or if you would like assistance with your existing Xero file.